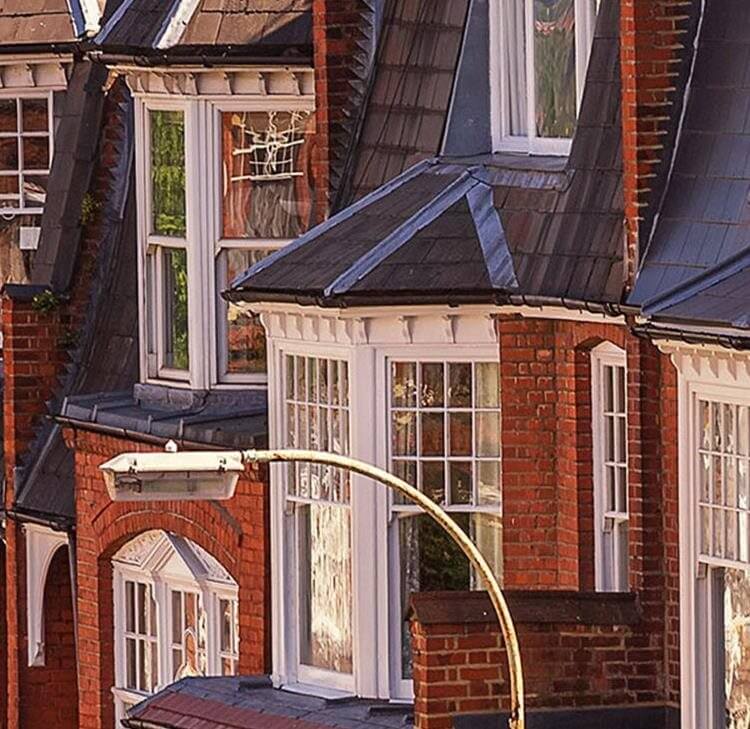

Real estate quarterly update – January to March 2022

Read more about our latest real estate update aimed at in-house lawyers practising in the property and real estate sector.

Cases

Ventgrove Ltd v Kuehne + Nagel Ltd [2021] CSOH 129

A tenant in Scotland had validly exercised a break option even though it failed to pay VAT on the break premium.

Brooke Homes (Bicester) Ltd v Portfolio Property Partners Ltd & Others [2021] EWHC 3015 (Ch)

The court provides some useful guidance on the different types of endeavours obligations and good faith clauses.

W (No.3) GP (Nominee A ) Ltd and another v J D Sports Fashion Plc (Nottingham County Court, 22 October 2021)

The County Court refuses the landlord’s request to include a turnover rent in a statutory lease renewal.

SPS Groundworks & Building Ltd v Mahil [2022] EWHC 371 (QB)

A seller failed on an auction sale to comply with its common law duty to disclose an overage obligation affecting the property.

Legislation and consultation

Leasehold Reform (Ground Rent) Act 2022

This Act received Royal Assent on 8 February 2022. Its main provisions are not yet in force, but the government has committed to the Act being fully in force within six months of Royal Assent (except in relation to retirement home leases, for whom the provisions will not come into force before 1 April 2023).

The key points to note are as follows:

- The Act restricts rents on new long residential leases (leases of single dwellings granted at a premium for a term certain exceeding 21 years) to one peppercorn per year (and also prohibits the charging of administration charges in relation to those peppercorn rents). Sums such as insurance, service charge etc. reserved as ‘rent’ do not count as rent for these purposes.

- The restriction will apply to leases of dwellings granted on or after commencement of the Act. However, the restriction will not apply to leases granted pursuant to pre-commencement contracts (unless granted pursuant to an option or right of first refusal).

- Business leases, statutory lease extensions of houses and flats, community housing leases and home finance plan leases are all excepted from the restriction. Special rules apply to shared ownership leases (where the restriction only applies to the tenant’s share in the property).

- A breach of the restriction will be a civil offence with a financial penalty of between £500 and £30,000. Leaseholders will be able to recover unlawfully charged ground rents from the First-tier Tribunal (in England).

Government to protect leaseholders with new laws to make industry pay for building safety

In a press release on 14 February 2022, the Secretary of State for Levelling Up announced tough new measures to protect leaseholders from exorbitant costs of removing unsafe cladding (and other building safety costs). These will be implemented through amendments to the Building Safety Bill currently going through parliament. The press release covered the following points:

- Regulations can be made which will allow the government to prevent developers who refuse to pay to remove unsafe cladding from obtaining planning permission and building regulation approval on new developments (effectively preventing them from building and selling new homes).

- The new building safety levy (which will be payable at the deposit of plans stage of building control) will be able to be applied to more developments (it was initially limited to higher-risk buildings), with scope for higher rates for those developers who do not participate in finding a workable solution to the cladding crisis.

- Developers will still be able to be held liable even if they have used shell companies to manage specific developments.

- Cost contribution orders will be able to be placed on manufacturers who have been successfully prosecuted under the Construction Products Regulations. These orders will require them to pay their fair share on buildings requiring remediation.

- Building owners and landlords will be able to take action against manufacturers who used defective products on a home that has since been found unfit for habitation. The limitation period for such claims relating to defective cladding will be 30 years (this mirrors a change to the Building Safety Bill announced on 30 January 2022 extending the limitation period for claims under the Defective Premises Act 1972 to 30 years).

- No leaseholder living in their own home (or subletting) in buildings over 11 metres will have to pay anything to remove dangerous cladding.

- In relation to non-cladding costs, developers that still own a building over 11 metres that they built or refurbished (or landlords linked to an original developer) will be required to pay in full to fix historic building safety issues. The same will apply to building owners who are not linked to the original developer, but who can afford to pay in full. If they cannot afford to pay, a cap will limit how much leaseholders will have to pay (£10,000 for homes outside London and £15,000 for homes in London) and any costs paid over the last 5 years will be included in this cap.

A copy of the press release can be viewed from here.

As it to be expected, this press release contains only a broad outline of the government’s proposed amendments to the Building Safety Bill. A building safety leaseholder protections factsheet published on 23 March 2022 contains more detail about the leaseholder protections (including who qualifies for the protections and how the caps work) and explains that the protections operate as a ‘waterfall’ - with developers paying first, followed by building owners and costs only falling on leaseholders where building owners need support.

A copy of the factsheet can be viewed from here. The government states in the factsheet that the protections will come into law two months after the Building Safety Bill receives Royal Assent (which the government hopes will be this summer).

Register of Overseas Entities

The Economic Crime (Transparency and Enforcement) Act 2022 has been rushed through parliament in the light of the current tragic events in Ukraine. Amongst other measures, the Act contains provisions which largely replicate (with some significant changes) the contents of the draft 2018 Registration of Overseas Entities Bill (which did not make the statute book at the time). It creates a new Register of Overseas Entities to be maintained by Companies House. The part of the Act which creates this new register is not yet in force, but the government has said that Companies House will now begin work to implement it as quickly as possible.

Some of the key points to note are as follows:

- The Act defines an ‘overseas entity’ as “a legal entity that is governed by the law of a country or territory outside the United Kingdom”. This includes therefore companies incorporated in the Channel Islands or the Isle of Man. A ‘legal entity’ is defined as “a body corporate, partnership or other entity that (in each case) is a legal person under the law by which it is governed.” Trusts are therefore not included.

- An overseas entity cannot apply to the Land Registry to register itself as the owner of a freehold estate or a leasehold estate for more than 7 years unless it has first registered its beneficial owner details on the Register of Overseas Entities. On registration, Companies House will allocate an overseas entity ID to the overseas entity.

- A restriction will be placed on the registered freehold and leasehold titles of an overseas entity (where the original application for registration was made in England or Wales after 1 January 1999) which will (subject to certain exceptions) prohibit registration of a transfer, a lease of over 7 years or a charge by the overseas entity unless it has complied with its beneficial owner registration and updating obligations. In addition, an overseas entity who makes such a disposition commits an offence.

- Where an overseas entity is entitled to be registered as proprietor of a freehold or leasehold title, the Land Registry must not (subject to certain exceptions) register a transfer, a lease of over 7 years or a charge by the overseas entity unless it has complied with its beneficial owner registration and updating obligations. In addition, an overseas entity who makes such a disposition commits an offence.

- Exceptions to the prohibitions mentioned in points 3 and 4 above include dispositions made pursuant to a statutory obligation or court order (e.g. a statutory lease renewal), those made pursuant to a contract made before the restriction was entered on the relevant title or the overseas entity became entitled to be registered as proprietor, those made by lenders (or by receivers appointed by lenders) exercising their power of sale and those made by certain insolvency practitioners.

- Where an overseas entity owns land in the United Kingdom at the time the Act comes into force (where the original application for registration was made in England or Wales after 1 January 1999), it will have a period of 6 months to apply to register its beneficial owner details on the Register of Overseas Entities (known as the ‘transitional period’). This transitional period has been significantly reduced from the original 18 months proposed in the first draft of the Bill. An overseas entity which fails to do this commits an offence.

- When applying to register its beneficial owner details before the end of the transitional period, an overseas entity must also give details of any transfers, leases of over 7 years or charges it has made since 28 February 2022 and must provide beneficial owner details as at the date immediately before any such disposition.

- An overseas entity commits an offence if it enters into a transfer, a lease of over 7 years or a charge between 28 February 2022 and the ending of the transitional period and has not applied to register its beneficial owner details on the Register of Overseas Entities by the end of the transitional period (and has not provided the information referred to in point 7 above). This stops an overseas entity taking advantage of the transitional period by disposing of all its properties during that period.

- Once it has registered its beneficial owner details on the Register of Overseas Entities, an overseas entity has a duty to update that information annually.

- The definition of a beneficial owner is modelled on the People with Significant Control regime, which has applied to UK companies since June 2016. This includes someone holding (directly or indirectly) more than 25% of the shares or voting rights in the overseas entity, someone holding the power to appoint or remove a majority of the directors of the overseas entity and someone having the right to exercise (or actually exercising) significant influence or control over the overseas entity. The Act (and regulations to be made under the Act) prescribe the detail that must be provided when an overseas entity applies to register its beneficial owner details on the Register of Overseas Entities.

- Criminal and civil sanctions on the overseas entity and/or its officers (depending on the offence) will apply for breaches of the obligations imposed.

Commercial Rent (Coronavirus) Act 2022

This Act dealing with the ring-fencing of arrears that accrued during the pandemic for affected tenants is now in force. This means that for leases falling within the Act (tenant businesses that were forced to close during the pandemic), landlords and tenants have six months from 24 March 2022 to refer to arbitration the question of how to deal with the ring-fenced arrears (failing which all the usual landlords’ remedies to recover those arrears will again become available). The Secretary of State does have power under the Act to make regulations to extend this deadline.

The Act itself not differ significantly from the draft Bill that we discussed in the last quarterly update (click here).

Under the Act, the Secretary of State can approve arbitration bodies to appoint arbitrators. The Royal Institution of Chartered Surveyors and the Chartered Institute of Arbitrators have both been approved as arbitration bodies.

Existing pandemic restrictions on landlords forfeiting leases, exercising Commercial Rent Arrears Recovery and winding-up companies have all now expired.

Reforming the leasehold and commonhold systems in England and Wales

This consultation has been launched by Department for Levelling Up, Housing & Communities and seeks views on reforms to the leasehold and commonhold system following recommendations in the Law Commission’s reports published in July 2020.

It seeks views on the following:

- increasing to 50% the non-residential limit for collective enfranchisement and right to manage claims;

- introducing a non-residential limit of 50% for individual freehold acquisitions;

- introducing mandatory leasebacks of non-participating units following collective enfranchisement;

- changes to voting rights in right to manage companies;

- how shared ownership products could work in commonhold settings; and

- the provision of information during the sale of a commonhold property.

The consultation ran until 22 February 2022. A copy of the consultation can be viewed from here.

Land registry

Digital Registration Service

Last year, the Land Registry announced that, from November 2022, most AP1 applications to change the register (e.g. transfers of whole) would have to be done electronically through the new Digital Registration Service (DRS).

At the time, the intention was that leases and transfers of part would not be part of the DRS service until 2023. However, following feedback, the Land Registry has announced that all transactions will have to be done through DRS from November 2022 (with the existing system of manually completed an AP1 and uploading it to the portal being withdrawn).

Practice Guide 82 – electronic signatures accepted by HM Land Registry

This new guide brings together in one place all the information previously found in a variety of guides and information published by the Land Registry. In particular, the information in the old section 13 of Practice Guide 8 (execution of deeds) (which set out in detail the Land Registry’s requirements for accepting for substantive registration electronically signed deeds and documents) can now be found in sections 3 and 5.2 of this guide. Going forwards therefore, a conveyancer’s certificate of compliance (an essential Land Registry requirement) should now refer to practice guide 82, rather than to practice guide 8 (see Appendix 2 of the new guide for the full wording).

Appendix 1 of the new guide contains a very useful table listing the documents that can be signed using so-called Mercury signatures (information on Mercury signings has also been moved from practice guide 8 to this new practice guide), documents that can be signed using a signing platform (described as a conveyancer-certified electronic signature) and documents that can be signed using other forms of electronic signature (e.g. a typed name, a scanned manuscript signature and the typing of a name at the end of an email).

A copy of the new practice guide can be viewed from here.

Miscellaneous

SCR (version 3.3): Solicitor's completion requirements

A new enquiry (5) has been added to this form to cover the signing of the completion documents.

In particular, it asks whether the completion documents will be signed using wet ink, Mercury or electronically and, crucially, it requests an undertaking to supply the conveyancer’s certificate required by the Land Registry to register any electronically signed documents. This should avoid the situation arising (to which at present there is no satisfactory solution) of completing a legally binding document which cannot be registered (because it was not signed in accordance with the Land Registry’s requirements now set out in Practice Guide 82).

Contact

David Harris

Professional Development Lawyer

david.harris@brownejacobson.com

+44 (0)115 934 2019