Lawyers from the corporate sectors at Browne Jacobson share their predictions for 2025.

Economic headwinds, such as rising interest rates, inflation, and global supply chain disruptions have led to a cautious mergers and acquisitions market in the Midlands, with businesses being more selective about acquisitions. Higher financing costs and adjusted valuations have impacted deal-making, particularly in capital-intensive sectors. The 2024 UK Budget could stimulate M&A activity, particularly in tech, green industries, food and drink and manufacturing, through tax incentives, capital allowances, and SME support.

Mergers and acquisitions deal activity in the Midlands is likely to continue the trend of fewer deals with higher values into 2025. Increased caution, driven by higher capital costs and economic uncertainty, may well lead companies to focus on strategic, high-value acquisitions rather than opportunistic or riskier deals. Consolidation in key sectors like manufacturing and tech, along with private equity and larger corporates seeking growth and expansion, could contribute to fewer transactions but larger deal values.

In 2025, mergers and acquisitions activity could spike in sectors related to technology, green energy, healthcare, food and drink, manufacturing, and fintech. Companies will continue to pursue acquisitions to enhance their capabilities, adapt to new regulations, and capitalise on emerging trends, such as digital transformation and sustainability. Mergers and acquisitions in tech will focus on consolidation and integration of advanced technologies like AI and cybersecurity and ESG factors will be crucial for successful transactions for large corporates and private equity firms.

Sam Sharp, Partner.

Private client

2024 was another busy year for our private client team, with clients keen to complete transactions and gifts prior to the budget in anticipation of capital gains tax (CGT) increases. In fact, some of the most significant changes for private clients announced in the budget were in relation to inheritance tax rather than CGT. While the restrictions to agricultural property relief (APR) and business property relief (BPR) and the inclusion of inherited pensions in the inheritance tax net will pose significant questions for our clients to consider in 2025, these changes are not due to be implemented until April 2026 and April 2027 respectively. The measures are subject to technical consultations taking place in early 2025 and draft legislation is not yet out so we expect 2025 to be a year in which clients take stock and delay taking any (irreversible) action until at least the draft legislation has been released.

The medium to long-term impact of the APR and BPR changes on farmland prices and sales volumes remains to be seen, although early indications are that prices are not softening despite the budget announcements, as land as an asset class remains popular with a range of investors. That said, farmers and other business owners may be less confident in taking out debt to invest in their businesses and so the volume of refinancing work may decrease - with the looming spectre of inheritance tax payments to fund as well as increases to NICs and the minimum wage, they will not want to (voluntarily) stretch their finances too much further.

Hannah Connors, Senior Associate.

Energy and infrastructure

The Great British Energy Bill, currently at the Committee stage in the House of Lords, aims to formally establish GBE. GBE seeks to bridge critical investment gaps, stimulate technological innovation, and bolster community-level energy production. While GBE’s broad objectives are clear (the government seeks “double onshore wind, triple solar power, and quadruple offshore wind”), questions remain regarding its precise role and operational scope, although current indications suggest it will fulfil roles both as an investment vehicle and a delivery agent. Its operational model combines the mobilisation of public funds to attract private sector investment with the capacity to actively deliver large-scale renewable energy projects, providing investment in emerging technologies (such as floating offshore wind, tidal power, and hydrogen production) the expansion of established technologies (such as solar, onshore wind, and nuclear) and promotion of small and medium-scale power generation schemes. GBE presents a range of opportunities, but as a new entity also presents some risks, the most pressing of which relate to legal compliance, financing governance, and workforce capacity.

Energy and infrastructure businesses need to remain alert to GBE’s evolving role and consider how they might position themselves, both commercially and legally, to seize the opportunities and mitigate the risks presented by this significant transformation in UK energy.

Zoe Stollard, Partner.

Technology

Given the rapid advancements in AI technology and its integration into various sectors, the legal industry, has experienced significant transformation in 2024. A key event that marked 2024 was the European Union (EU) AI Act, which was enacted on 1 August 2024, setting out a regulatory framework for the use of AI across the EU and impacting entities outside the EU that affect EU citizens. This act introduces critical transition periods, including AI literacy requirements and prohibitions on certain AI systems starting from 2 February 2025. The European Data Protection Board (EDPB) in late December 2024 important guidelines for the integration and deployment of AI technologies under data protection laws, separately from the AI Act regime. So there is much to keep abreast of in this area whether you are developing or deploying AI.

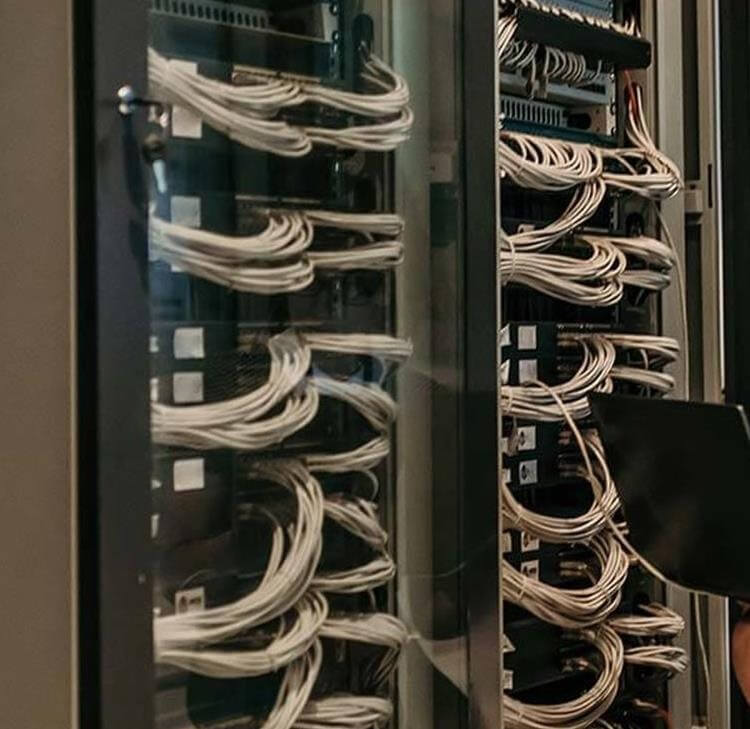

There is a critical need for robust data protection mechanisms, especially as businesses transition from experimental phases to more comprehensive, enterprise-wide AI deployments. The expansion of AI within distributed architectures, such modern data centres, highlights the urgency for advanced security measures that ensure privacy, security, and compliance across all levels of data processing. With AI agents becoming more common and generating vast amounts of data, the development of AI-driven data protection strategies that can properly manage and safeguard this information will be key area for innovation and focus in the coming year. So too will assisting clients in determining which of their teams (Compliance, Risk, Legal, Data governance?) or a combination of them, will be tasked with this effort.

Jeanne Kelly, Partner.

Construction

The construction industry has encountered unprecedented growth in the use of Artificial Intelligence (AI) technologies to fulfil projects. Looking ahead, the incorporation of AI is clearly going to become even more prevalent in the market in 2025. The move towards a more digitally enhanced industry is becoming more topical as time moves forward. Whilst the industry is navigating the various advancing technological changes, stakeholders need to be aware of any legal risks that might arise as AI starts or continues to be embedded into construction projects.

Over the last year, there has been a substantial increase in demand for the creation and development of data centres, to host the exponential growth of data being created across various platforms. The delivery of such large projects poses a number of challenges. The use of 3D models in construction projects may be economical but poses challenges, for example in relation to litigation. Moving forward into 2025, it will be interesting to see the growth in AI powered tools theoretically making sites safer and more energy efficient, as well as how the industry continues to utilise AI in other ways to further the construction industry.

The rise of AI over the last few years has led to an exponential growth in the need for, and the development and creation of data centres. At present, data centres worldwide consume around 1 – 2% of overall power, however with the growth in applications such as agentic chatbots, image generation tools, autonomous vehicles and smart manufacturing tools this is likely to double or even triple over the next five to ten years. It has become ever more vital that businesses ensure that data centres are built with advanced infrastructure and energy solutions to combat the vast amount of data that will be generated in the future.

Zoe Stollard, Partner.

Real estate and construction

2024 was an eventful year for the real estate and construction sector. Again, we saw high numbers of insolvencies at all levels of the market, including established developers and contractors – most notably ISG, the impact of which was felt throughout supply chains across the country. The new government has had a lot to say about housing, planning and increased spending on infrastructure, but we have yet to see how that will play out. Persistently high interest rates and ongoing uncertainty have had a negative effect on building, with many stakeholders having concluded that taking on new finance for large projects should wait.

Looking forward to what 2025 is likely to bring, developers should see some growth in housebuilding as a result of interest rates and inflation slowly coming down, and with the government’s reintroduction of mandatory affordable housing targets. Sustainability is the key issue for the industry going forwards, both in terms of materials and practices; this will have a profound effect with re-use and re-purpose being the new norm, rather than knock down and replace as has been the case previously. Linked to this is the requirement for biodiversity net gain, which means all building projects must actively improve the natural environment through innovative approaches to planning and land management. The Procurement Act 2023 is one of the biggest reforms to public procurement law in years and will impact throughout the public sector and infrastructure projects. Across the industry companies continue to adjust to the many important requirements imposed by the Building Safety Act. Finally the rise in AI is having a profound effect on the sector, both in terms of AI being used to improve construction and development practices, safety and efficiency, but also with the increased demand for data centres.

Nick Cook, Legal Director.

Automotive

The UK automotive industry faced significant challenges in 2024, particularly with the introduction of the ZEV Mandate, pushing for net zero and positioning the UK among the leaders in stringent net zero targets. This transition has been costly, leading to notable impacts such as the closure of the historic Vauxhall factory in Luton.

Despite billions being invested into the industry’s transition to net zero, demand remains low, with EVs making up less than 19% of the UK automotive market in 2024. The shear costs of the investment combined with the heavy EV discounting to meet the stringent demands of the ZEV Mandate has risen above £4 billion, which is not commercially viable.

Demand for EVs needs to rise dramatically in the UK for the automotive industry to strengthen alongside decarbonisation. Looking to 2025, industry leaders will be eagerly awaiting potential ‘flexibility’ changes to the ZEV Mandate following the Government’s Christmas Eve press release and lawmakers will need to consider how best to incentivise demand whilst encouraging further UK investment and innovation.

The Automated Vehicles Act 2024 is set to significantly influence the industry, establishing a legal framework for automated vehicles. As a consequence, the Act will impact automated vehicle manufacturers, designers, software developers, and others involved with self-driving vehicles, imposing stringent obligations and restrictions that these industry stakeholders will need to pay close attention to.

As the automotive industry navigates these regulatory landscapes, the focus on decarbonisation and automation will likely shape its evolution.

Joe Davis and Conor Macaire Duncan.

Fashion and beauty

2024 was a tumultuous year for fashion and beauty, with large established brands (including Nike) and smaller independent brands alike facing huge pressures. Pressures came from the changing geopolitical landscape, disruptions to supply chains, inflation, weakening consumer confidence, and (in the case of independent brands) a shake-up of the wholesale market exacerbated by the collapse of Matchesfashion, changes in ownership of other luxury online marketplaces and weakening department store performance.

As we start 2025, big changes are afoot, including in the US, where within days TikTok may be forced to shut down, with implications for thousands of fashion and beauty brands and influencers. The start of the second Trump administration also heralds potential seismic trade changes including substantial tariffs on imports. Brands will look to diversify their manufacturing locations and grow in booming markets such as India and Japan.

In the UK, fashion and beauty brands face another year of uncertainty and regulation, coupled with steep rises in operating costs. From April, The Competition and Markets Authority will be able to impose huge fines on brands for consumer law breaches when parts of the Digital Markets, Competition and Consumers Act 2024 come into force. We are in a new dawn of consumer power, and fashion and beauty brands can expect the CMA to continue to root out greenwashing claims as a priority. As brands seek to ensure ongoing revenue and customer loyalty with membership and subscription services, they should note new laws on subscription contracts expected in 2026. AI will continue to provide opportunities to offer inundated consumers what they want. Overall, brands will face a slew of regulation within the UK and EU, including the biggest change in employment rights for a generation, on AI, modern slavery in the supply chain, packaging, product safety and sustainability.

Emma Roake, Partner.

![Contractual liability for all inclusive treatment: Bartolomucci v Circle Health Group Limited [2025]](/getattachment/95f9533b-f99c-4fcc-b8d5-3f93904b8242/shutterstock_1265400856.jpg?variant=HeroImageTabletVariantDefinition)