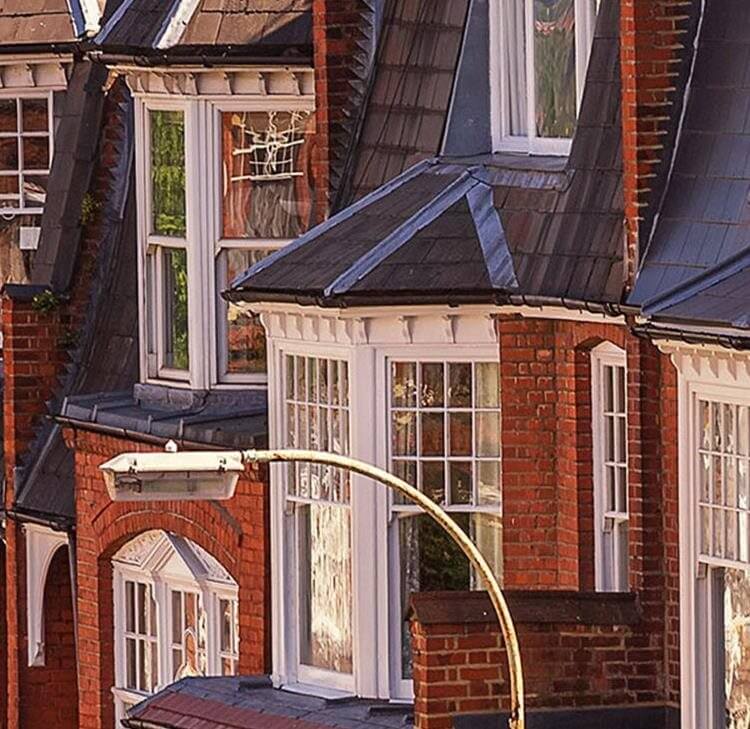

The first quarter of 2023 saw the sale of Deutsche Bank’s office, Winchester House, to Malaysian Investors and BlackStone’s agreement to sell St Katharine Docks to a Singaporean group. Analysts have determined that it is due to the repricing of office values in the fourth quarter of 2022 coupled with the relative strength of the dollar over the pound.

The increase in interest from the Asian market is suggestive of the strength of the UK’s commercial property market. This should hopefully lead to further investor confidence from other international investors and national investors as well.

Despite the turbulence of the banking sector, there is continued activity in the UK commercial property market, with deals still being finalised. Although investor confidence has been shaken because of the banks, some property investors closely following the market will be looking to invest more as the market gets stronger. As noted by the FT, “It’s all a confidence game. Until we get more deals to happen, people will sit on the sidelines”.

The market is seeing an impact from international investors. Landlords may well be seeing an increase in interest by both national and international investors.

In our view, Tenants may want to consider tying up deals with landlords and they should continue to be wary of change of control clauses in their contracts.

Key contact

Mark Hickson

Head of Business Development

onlineteaminbox@brownejacobson.com

+44 (0)370 270 6000