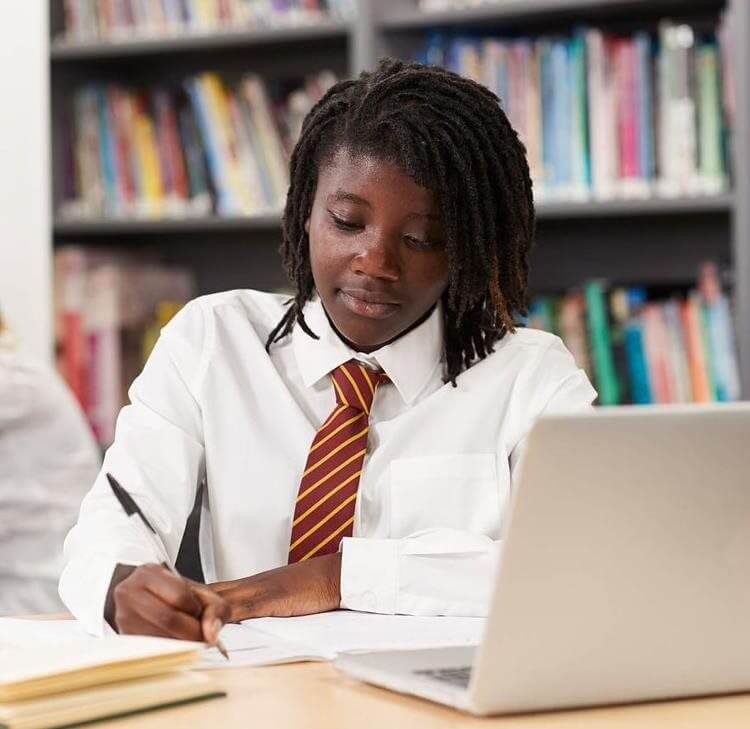

Schools and Raising Money for Charities

Traditionally there are many ways for schools to raise money for charity: bake sales, non-uniform days and throwing wet sponges at teachers.

Traditionally there are many ways for schools to raise money for charity: bake sales, non-uniform days and throwing wet sponges at teachers. However, times have changed and school fundraising is more high tech; Just Giving and GoFundMe accounts are common place. If you are raising money through either traditional or modern means, we consider the methods that you can continue to do so legally, and in compliance with charity law.

The bodies that run most types of schools are state-funded independent charities and their governors are charity trustees. Unlike most charities, they do not have to register with the Charity Commission and are called exempt charities. Therefore school governors and academy directors are also charity trustees and this means that they have ultimate responsibility for the charity and its property and the extra duties that fundraising law adds to the role. This includes compliance with financial and charitable regulations.

It is important that schools and academy trusts have a fundraising policy in place; this will help with goals, organisation and setting out the parameters for donations/fundraising. A good policy should not only set out the wording to be used in public appeals and outline how any money raised will be held, but should also cover when donations might be refused and when money may be returned to a donor.

If you are thinking of raising money for charity, you will need to carefully consider the wording of any publicity. Depending on how you word the request you may be free to spend the money raised on whatever you wish or be limited to only using it for a very specific purpose. Being over-specific in your fundraising literature can lead to issues if the money raised can only be used for that very specific purpose and the funds raised are not exhausted on the subject matter e.g. fundraising generated £1,000 of donations to buy a £500 water pump. The left-over funds are classed by the Charity Commission as a “subsequent failure” and can require the Commission’s consent before the left-over money can be used for an alternative purpose if the wording of the original request hasn’t been set out wide enough with flexibility if more money is raised than is required. This can often catch schools out and leave them falling foul of the rules by spending the left-over cash on items outside of the original purpose. This issue can be avoided by carefully wording fundraising publicity to make it clear that, although the intention is to use money for a particular purpose, if surplus funds are generated or the situation changes, the school is able to use the money raised for alternative purposes.

Another issue schools often come up against is money donated by wealthy individuals or left in wills which are then seen as ‘tainted’ if the donor turns out to have undesirable qualities or criminal convictions linked to them. Often the money has been spent and schools have great concerns about press coverage and reputation impact. Often the Charity Commission will not have an issue here, as money was accepted in good faith.

Alternatively, a gift may be offered to the school but with onerous or unpalatable conditions attached to it that the school feels unable or unwilling to comply with.

What we would recommend is having a policy on accepting, refusing or returning donations to help in these circumstances; we can assist you with a template policy if needed.

In summary you can plan your fundraising more effectively by considering a few key factors:

- how much you want to raise - is there something particular you want to use the money for and a minimum amount you need?

- do you have a clear, well-drafted policy on how you accept, refuse or return donations or gifts?

- how are you wording your publication material? Are you giving yourselves the freedom you need in case you cannot achieve your intended purpose or, more positively, overachieve it?

Contact

Laura Murphy

Associate

Laura.murphy@brownejacobson.com

+44 (0)115 908 4886