Rise in the cost of borrowing from the Public Works Loan Board - to harm project viability?

The Treasury’s recent decision to raise the borrowing rate from the Public Works Loan Board (PWLB) (from 1.8% to 2.8%) will inevitably increase the cost of infrastructure projects as councils face higher interest rates.

This article is taken from November's public matters newsletter. Click here to view more articles from this issue.

Decision

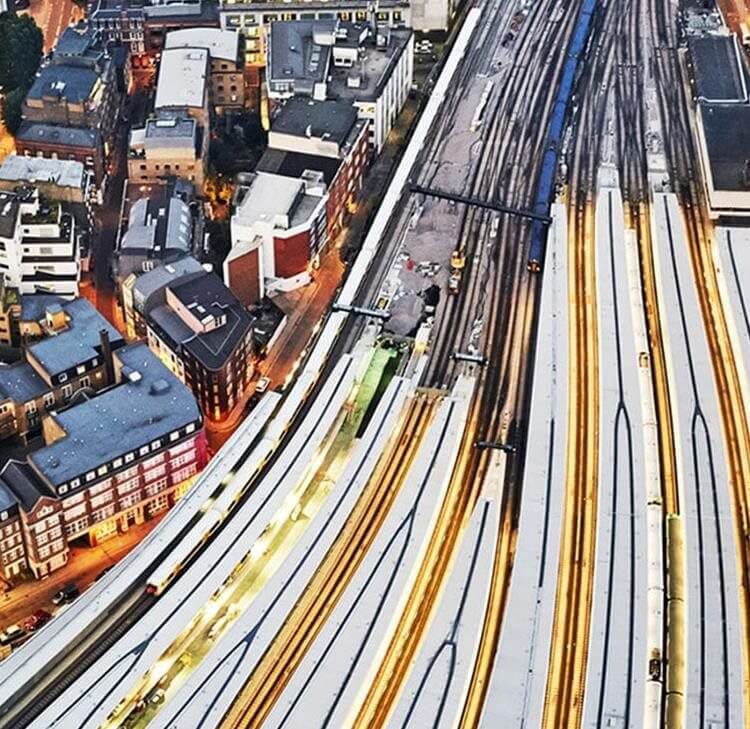

The Treasury’s recent decision to raise the borrowing rate from the Public Works Loan Board (PWLB) (from 1.8% to 2.8%) will inevitably increase the cost of infrastructure projects as councils face higher interest rates. The PWLB is the primary source of borrowing for local councils to access lower rates of interest, to finance and fund infrastructure projects, including regeneration schemes.

Impact

Whilst the national impact of this decision is unknown, it is predicted by the Local Government Association that the change in the PWLB borrowing rate could cost councils an extra £70 million a year. Manchester City Council has also estimated that the PWLB rate rise would equate to an additional cost of £18.9 million for planned borrowing on capital projects up to 2024.

The new PWLB rate is likely to have negative consequences on housing and regeneration schemes, especially projects which are considered borderline in terms of viability. These projects are likely to have to be scaled back or suspended, resulting in fewer affordable homes being built.

Opposition

Councillors and Mayors across London have submitted a written request to the Treasury for the decision to be reversed, or for there to be an exemption where funds are borrowed to fund house building and regeneration schemes. Councils are currently eligible to apply for a discounted PWLB borrowing rate of 60 basis points above gilts for non-housing infrastructure projects. It is proposed that a similar approach is taken to ensure accessibility to funding continues for housing and regeneration schemes. Despite the opposition, the Treasury has defended its decision and increased the overall cap on the amount local governments can borrow from the PWLB, from £85 million to £95 million.

Alternatives

Local councils may instead have to consider alternative sources of funding for projects such as pension funds, bank lending or private investors, which may now be able to offer cheaper rates of borrowing than the PWLB. However, the credit rating agency Moody’s considers that the PWLB will remain councils’ primary source of finance despite the rate rise. If local authorities decide to take advantage of cheaper borrowing rates offered by the private sector, they will need to carefully review any terms and conditions to consider any additional covenants which may apply.