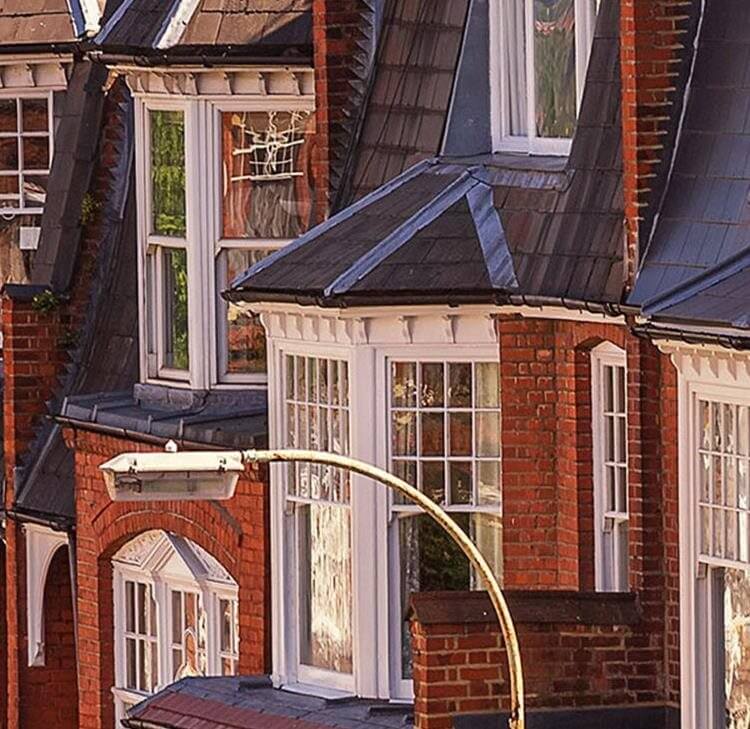

Real estate investment

At Browne Jacobson, social and environmental impact are at the top of the business agenda and our reputation for delivering cost-effective real estate services sets us apart.

Our real estate team has a strong and long-standing reputation for delivering the very best expertise across all areas of real estate investment.

Clients in the private and public sectors trust us with their investment property. We understand the importance of timely, commercial, and practical advice across all aspects of your real estate portfolio.

We also address the wider social concerns of the sector, especially the ESG aspirations of investors and their investment managers.

Our expertise is as broad as it is deep, spanning acquisitions and disposals of large, multi-tenanted, investment properties (including property tax issues; sales and purchases, lease grants and renewals, SDLT, VAT issues and tax issues on larger one-off transactions) through to construction, assigning existing contracts or (for public sector clients) procurement issues, intellectual property transfers or disputes as well as planning, environmental, insolvency and employment, as well as transactional work relating to large portfolios (such as new leases and renewals, including green lease clauses, dealing with applications for consent and related licences, surrenders and variations) and issues with current tenants (including the lease renewal process from service of a Section 25 Notice under the Landlord and Tenant Act 1954, reviewing any notice served by a tenant, claims for dilapidations, enforcement of tenant covenants, rent recovery from a tenant and/or guarantor and forfeiture of leases and/or service of Section 146 Notices.

Featured experience

An institutional investor (pension fund)

Sale of £44m industrial investment property to overseas investor.

Avon Capital Estates

Interim dilapidations claim where client’s surveyors re-entered the premises to carry the works out and recovered the cost from the tenant as a debt.

Birmingham City Council

£26.4m acquisition of ‘best in class’ building 9 Colmore Row.

Various councils

Full legal support in asset management of various shopping centres.

Key contact